💰 Sold over $45 million DTC 👉🏻 Topics: Business, Personal growth, Money & Life Tips ⚡️ Bootstrapped founder of @bestselfco (acquired 2022)

STOP working for money (& other big news) 😬

Hey friend,

If you're reading this email then likely know how to make money, but do you know how to make money work for you?

I had $758 in my pocket when I landed in New York City in 2012. That 💵 and the two suitcases of personal belongings I brought were everything I had.

When I started earning enough to have anything left over to save I was overwhelmed at the number of investment choices available. With fast-talking sales representatives telling me their investment opportunity was the “correct” choice.

(Narrator: The advisor working out of a tiny Chase bank in Queens was not the correct choice of people to "beat the market". Luckily I read this bookfirst 😂)

Since getting into entrepreneurship I’ve learned some expensive lessons about money.

In the next few emails I will teach you everything I’ve learned. This should save you the growth pains I experienced. And what led to me establishing my Money Rules.

1. Make Money

At the beginning of your career, making money was my only priority.

I needed to make enough to cover my burn rate (monthly living allowance). That was around $2800 a month to start in NYC (I lived as frugal as possible). I wasn't focused on building a company or coming up with the next "big idea" until my burn was covered.

I see many people getting started who think they need to create the next facebook and it’s stressful AF. The business I started in 2012 as a side-hustle was my “freedom vehicle”. It would get me from A to B, but I didn't need to commit to it for life.

Step 1: Find your freedom vehicle!

Once you’ve made money, you have to figure out how to keep it!

2. Keep Money

Amassing wealth isn’t about earnings. It’s about keeping more than you spend!

This means your lifestyle shouldn’t expand every time you start making more money — or you’ll never escape the rat race. This is called lifestyle creep. Avoid it like the plague.

We all know people who make a TON of money, but can’t get out of the rat race because they spend all of it.

Don’t try to keep up with the Jones’s (‘cause they’re probably in debt)

Whether you reduce your monthly burn or save more than you spend — this will get you to the third purpose of money.

3. Optimize Money

Early in my career, I decided optimizing my money required me to spend money. When you have more money you can use it for what it is, a commodity to be traded. You can use it to buy skills, time, cashflow or even a ticket to the right room.

Level up

“The best investment you can make is an investment in yourself. The more you learn, the more you'll earn.” — Warren Buffet

The best way I spent money early in my career was investing in myself. The easiest way to earn more money is to level up your skills with personal development. Stop betting on stocks, start betting on yourself — because you only have control of that outcome.

It's been ten years since I moved here and my life has completely transformed. And it all started with investing in myself.

As I learned and practiced new frameworks and skillsets, revenues in my businesses grew. This is why I never think twice about investing heavily in health or self-education – especially when I need to learn a specific skill set to reach a new goal in my life or business.

Build your network

One of the biggest pieces of advice I tell people who want to level up is to focus on getting in the right rooms.

There’s only so much you can learn and do solo, the right people can be a huge shortcut to getting where you want. You can cut years of frustration off with the right people around you.

One of the best investments I made was in a mastermind group called Baby Bathwater Institute.

I went to my first event in 2017, became a member shortly after and am still a member five years later. It’s like having a very experienced board of advisors I can go to for advice. Not only that but some of my closest friends came from this group.

Here’s a shot from an event last month:

Sound interesting? Learn more and apply for an upcoming event (no affiliation, in fact I’ve asked that they pass any promo credits onto anyone on my list that applies and gets invited). Maybe see you there?

End of Year Cleanup

As we wrap up the year and start planning for 2023, something you should be considering is getting started on your taxes… no not filing, but the prep work.

The best time to prep for taxes is not the month before they are due, but before the end of the prior tax year.

Remember it’s not how much you make, but how much you keep.

My friend Mitch (a real-life CPA) posted a thread of recommendations of what to do here.

Note: This advice is focused towards US tax payers (sorry for my international peeps, but hey at least you have decent healthcare 🙃)

Ways I'm reducing taxable income:

- Max out 401k. Limit is $20,500 for 2022 (I use Ocho.com)

- Max out HSA. Limit is $7300 for families / $3,650 for individuals (I use Lively for this)

- Charitable giving (limited to 50% of your gross income)

- Cost segregation study (more on this in future email)

- Loss harvesting (lots of this in 2022 due stocks & crypto 🥲)

The wash-sale rule prohibits selling an investment (stock) for a loss and replacing it with the same or a "substantially identical" investment 30 days before or after the sale.

Pro Tip: Because this rule doesn’t exist with crypto (yet), you can use it to reduce your taxable income.

For example if you bought BTC at $40k and it dropped to $17k you can sell it, lock in a $23k loss and then buy it right back again. You have the same amount of BTC as before but now you have reduced your overall taxable income by $23,000.

2023 Goals

Now taxes aren’t the only thing you should be working on. December is a great time to start building momentum for those 2023 goals!

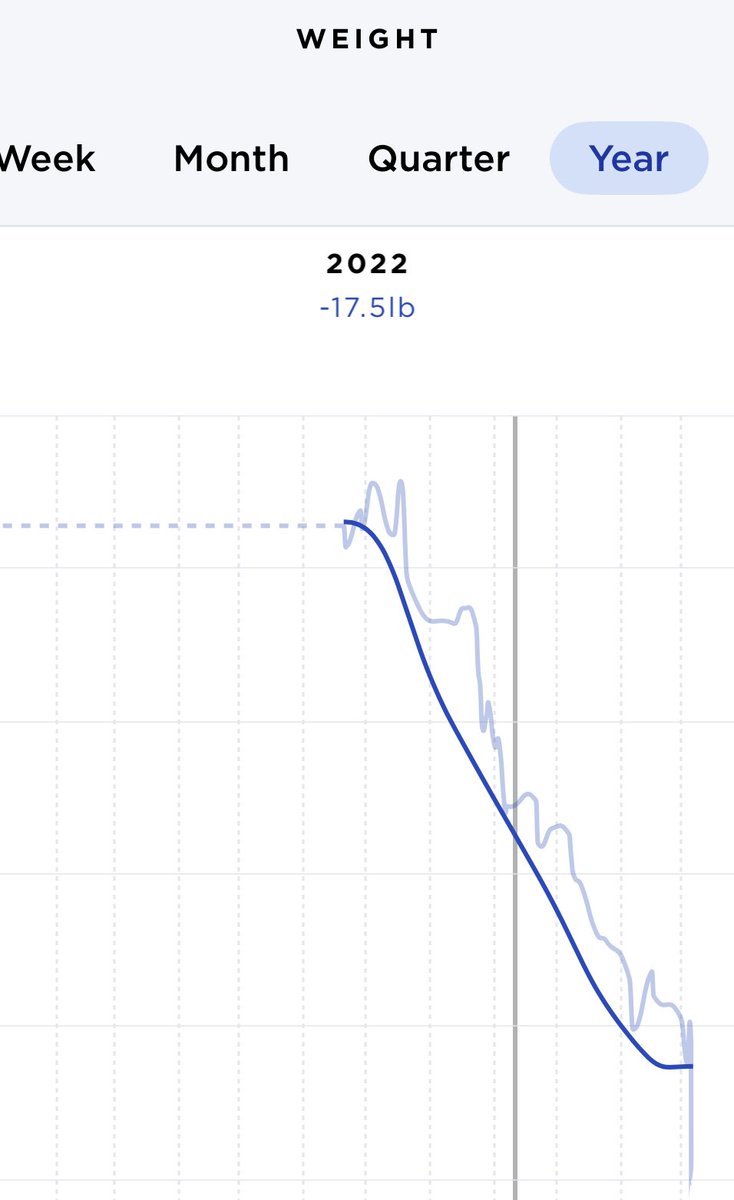

One of my goals has been losing the baby weight. Halfway there:

December 8th 2022

|

If you want to know how I break big goals down, here's a post sharing the same process I’ve used to both lose weight, grow my company and make even the biggest goals totally realistic.

Have a great week!

Cathryn

P.S Saving the most exciting news until last. I’m excited to share that BestSelf was recently acquired 🎉(consider this my first public announcement, aren’t you glad you read down to the P.S 😜).

I will be sharing more details on it soon — and what it means for me moving forward!

Thanks for your support.

LittleMight

💰 Sold over $45 million DTC 👉🏻 Topics: Business, Personal growth, Money & Life Tips ⚡️ Bootstrapped founder of @bestselfco (acquired 2022)